A Smarter Engine for Every Step

Our platform provides a complete toolkit to enhance your claims and underwriting lifecycle.

Leverage AI to instantly verify claim details, check for inconsistencies, and run comprehensive fraud analysis, ensuring only legitimate claims proceed.

From first notice of loss to final payment, our engine automates the entire claims lifecycle, reducing manual effort and accelerating resolution times.

Go beyond the policy. Our system performs user validation and assesses behavioral and historical data to generate a holistic user risk score.

Continuously monitor and analyze risks associated with specific policies, using real-time data to provide actionable insights for your underwriting team.

Built for the Insurance Ecosystem

Our platform is designed to empower the key players in the insurance industry.

Ideal for:

Ideal for:

Ideal for:

How You Connect

Embed our powerful claims and risk assessment logic directly into your existing systems. Our well-documented REST API allows for flexible and robust integration, giving you full control.

- Full API access to all engine features

- Real-time data webhooks

- SDKs for popular languages

- Comprehensive developer documentation

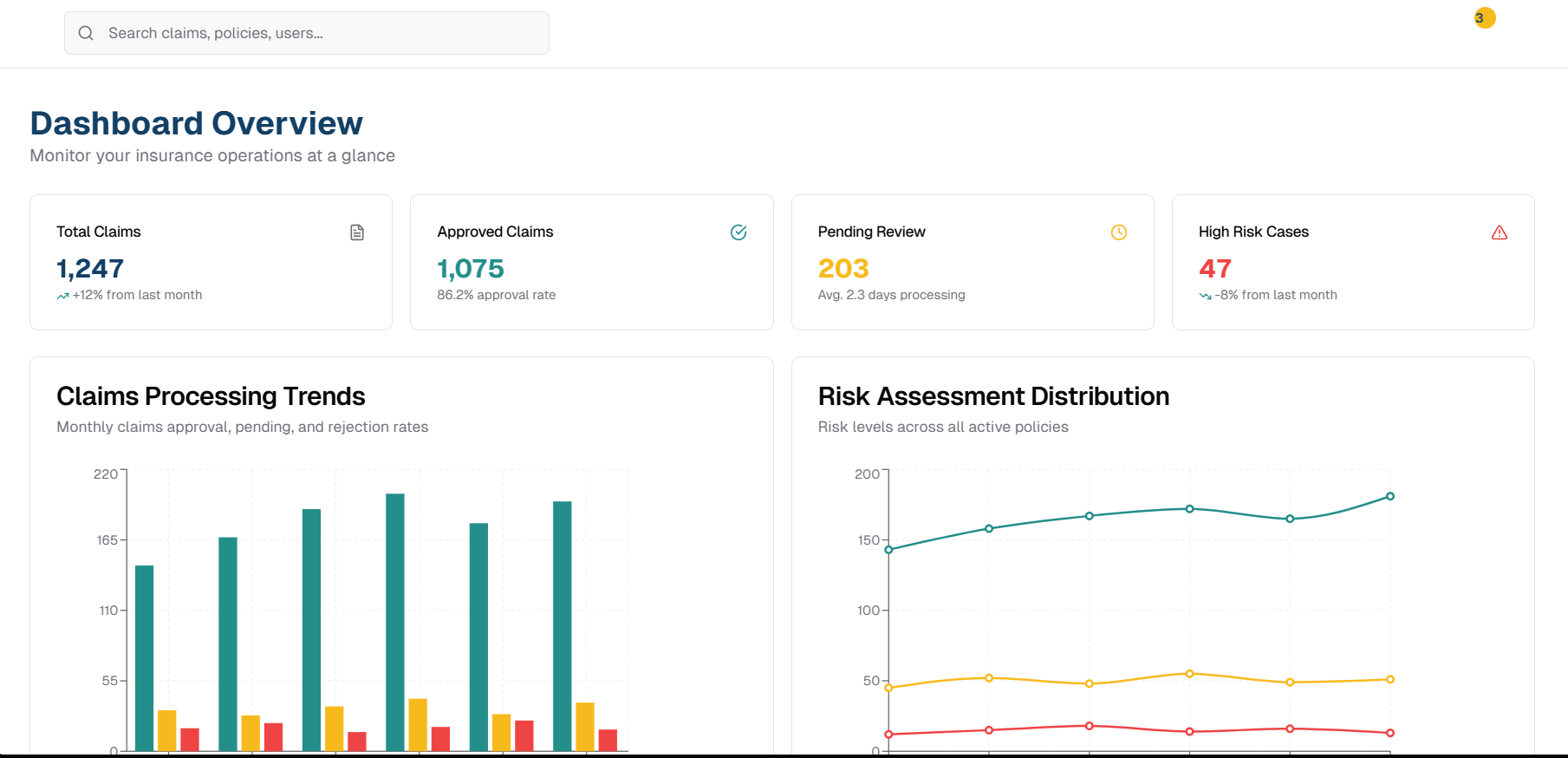

Manage everything from a central hub. Monitor claim statuses, review risk assessments, configure rules, and generate detailed reports without writing a single line of code.

- Live performance monitoring

- Customizable reporting tools

- User and role management

- Manual review and override capabilities